eKYC for the Banking, Financial services and Insurance (BFSI) industry to Prevent Illegal Online Practices

eKYC (Electronic Know Your Customer) is an electronic process for verifying the identity of customers.

The goal is to use eKYC biometric technology to curb money laundering and enhance identity verification. In response to the growing threat of online financial fraud, the banking and insurance industries have adopted eKYC and AML (Anti-Money Laundering) standards to prevent fraud, money laundering, and fraudulent use of digital identity.

Many banks and insurance companies also gradually import AI facial recognition technology into their systems to prevent payment fraud, deter financial crimes, and enhance customer identification and authentication processes.

eKYC Process Flow

1. Fill in personal information

Create a user ID and information and confirm that the users are above the age of twenty.

2. Identity Verification

User ID verification and identity card information. Or Internet banking account verification.

3. Mobile Phone Verification

Use OTP dynamic password to verify the user's mobile phone number.

4. Complete registration

Complete user registration.

5. Enter the remote platform

Enter the remote service platform for the identification process.

6. Sign the consent form

Read the biological data storage and identification documents then sign the consent form.

7. System Data Matching

Check the ID card information with the DOI for accuracy.

8. Face recognition

Face and ID card comparison.

9. Data storage

Face data collection and storage.

10. Finish the EKYC process

After completing the EKYC process, enter the video conference room.

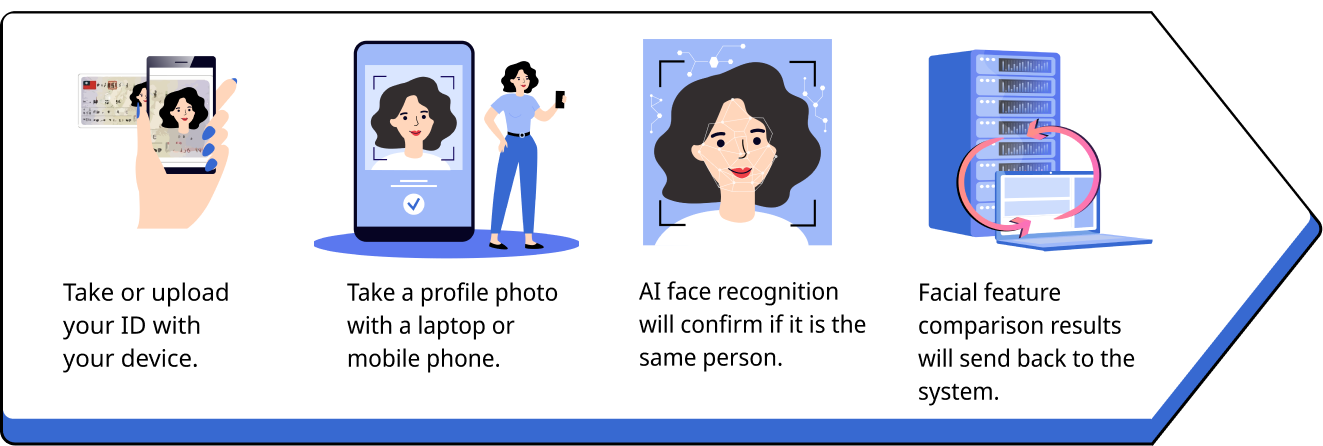

Ionetworks eKYC Face Recognition Technology Process

ID Card Authentication

Customers use their mobile phones or tablets to take photos of the front and back of their ID cards and then verify their authenticity.

ePassport NFC scanning

It can support electronic passport identification and read. And use NFC induction to read the identity information on the passport accurately.

Live recognition/anti-counterfeiting

It adopts visual anti-counterfeiting technology combined with biometric identification technology. Use 2D or 3D lenses for anti-counterfeiting identification. Effectively prevent the intrusion of masks, various photos, and videos on mobile phones and tablets.

Face recognition and ID card verification

AI face recognition will confirm whether the photo and the image on the ID card are of the same person.

OCR SDK

Customers can take a photo of their ID card, and use the document text reading technology to display the text recognition result in real-time. It also saves the time for customers to manually enter text, making the identification process more efficient.

Meeting SDK

Applicable to long-distance insurance. Integrate the recognition function of face/ID card anti-counterfeiting/OCR into the service.

Successful case

Results

Related Products

Turing Series-EZ Match Face

EZ Match Face is a facial recognition software developed based on AI artificial intelligence. It has the best user experience and the fastest deployment, and can be integrated into the EZ Pro image management platform or executed separately.